45 calculating tax math worksheets

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes Everyday Math Skills Workbooks series - Money Math - CDÉACF invisible. But math is present in our world all the time – in the workplace, in our homes, and in our personal lives. You are using math every time you go to the bank, buy something on sale, calculate your wages, calculate GST or a tip. Money Math is one workbook of the Everyday Math Skills series. The other workbooks are: • Kitchen Math

Calculating Your Paycheck Salary Worksheet 1 Answer Key Pdf Download 60+ Salary Slip Templates for Free (Excel and Word) to help you prepare your Salary Slip easily. The monthly salary that is credited to your bank account is always less than what you signed up for in the employment offer letter. This is so because of the structure of your salary and the tax implications on it.

Calculating tax math worksheets

Extraneous solution calculator - softmath free printable math worksheets. grade 4/5 ; method to solve first order differentiation ; free worksheet generator, equations with variables on both sides ; gr 8 math worksheets ; 6th math + box-and-whiskers-plots ; how to calculate exponents in square root ; letter multiplying integers ; slope calculater ; java aptitude questions for free download Self-Employed Individuals – Calculating Your Own Retirement … Nov 05, 2021 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans. Calculate Sales Tax | Worksheet | Education.com Entire Library Worksheets Fourth Grade Math Calculate Sales Tax. Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

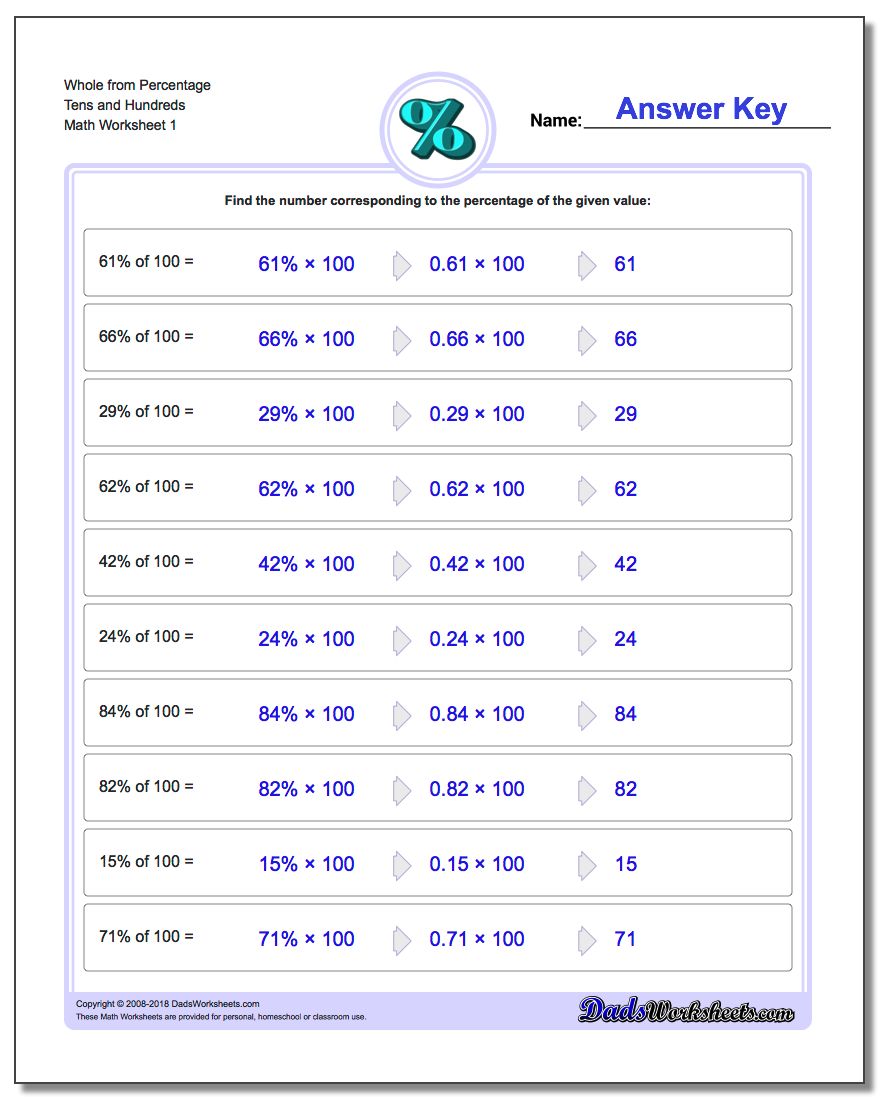

Calculating tax math worksheets. Calculating Tax Worksheet Teaching Resources | Teachers Pay Teachers Each theme has different problems.Each activity packet is designed for students needing to learn to convert percents to decimals, as well as perform calculations to determine the final price after sales tax. There are 8 pages and 3 sections to this product. The first section (2 pages) focuses on writing a percent as a decimal. How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems. Discount = = Multiply the regular price by the rate of discount. Selling price = = original price - - discount. Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price. Calculating Income Tax Worksheets - K12 Workbook Displaying all worksheets related to - Calculating Income Tax. Worksheets are Income calculation work, Calculation of income work instructions, Income calculations, Work calculating marginal average taxes, Standard deduction and tax computation, Income taxes, Calculating wages and salaries work takes, Calculating income fannie mae and freddie mac guidelines. Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Worksheet See in a set (11) View answers Add to collection

How to calculate taxes and discounts | Basic Concept ... - Cuemath The formula used to calculate tax on the selling price is given below: Tax amount = $(S.P.× T ax rate 100) $ ( S. P. × T a x r a t e 100) Let's consider an example. Let's say an item costs $50, and a sales tax of 5% was charged. What would be the bill amount? Let's first find 5% of 50. 5/100×50 = 2.5 Calculating Sales Tax Worksheets & Teaching Resources | TpT It is an independent activity for students to practice calculating sales tax. The worksheet that accompanies this PowerPoint can be found by purchasing the Sales Tax Lesson. ... students practice adding, subtracting, and multiplying decimals with this printable and digital real-world Christmas math activity. Students calculate the cost of a ... Consumer Math - Basic-mathematics.com Consumer math teaches you to apply your basic math skills to every day situations, such as budgeting, consumer credit, taxes ... Mortgage loans Learn about some important basic math skills that you need to know in calculating your mortgage loans. Real state tax Learn how a property tax is calculated using some basic math skills. Topics in ... Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

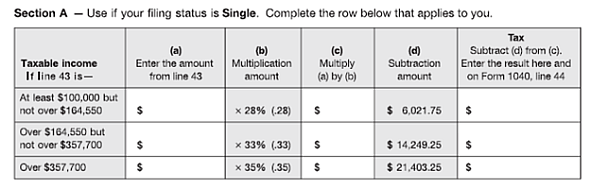

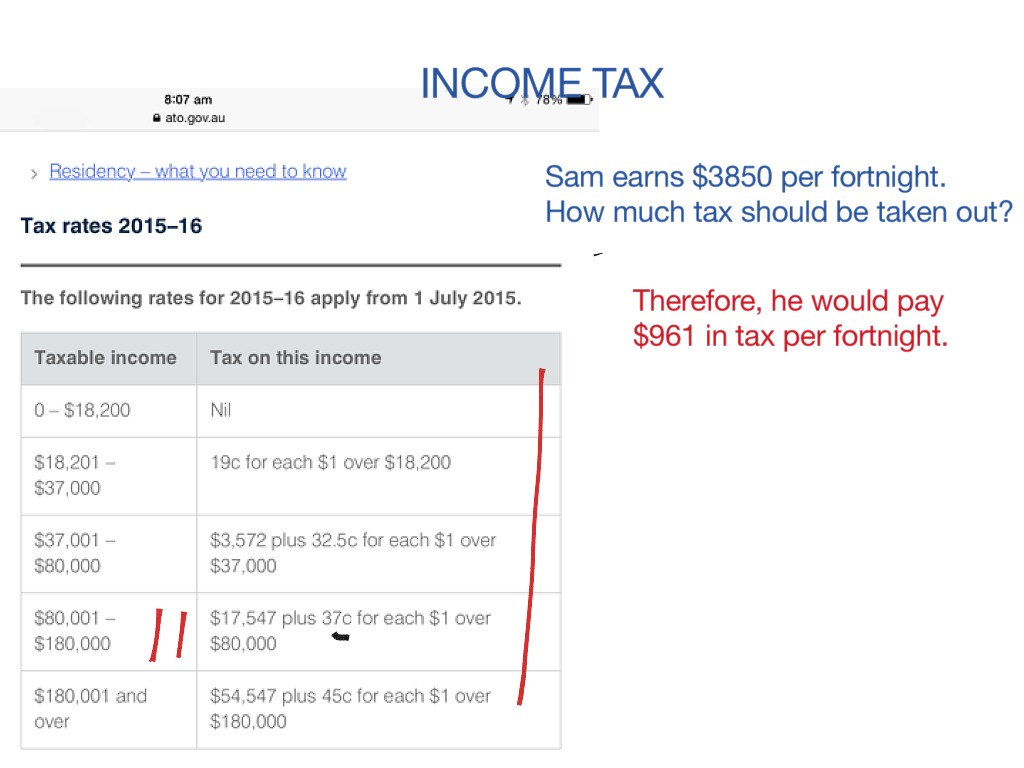

Discount Worksheets Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets. Comparing Discounts. Don't ... Utilize our specially curated printable worksheets and watch smart learners grow from novices into expert sales tax calculators by delving into a sea of fascinating ... Math Worksheets 4 Kids. PDF Tribal Taxes Math Worksheet - Oregon Tribal Taxes Math Worksheet (Continued) Step 4 Use the table and/or chart above to write a piecewise function to calculate actual federal income taxes owed for a given income. x = Income in dollars T(x) = Federal income tax owed (by a single taxpayer) Step 5 Use your piecewise function to calculate how much John owes in federal income taxes. PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25 Calculating Percentage Increase And Decrease - Math Goodies Learn About Calculating Percent Increase And Decrease With The Following Examples And Interactive Exercises. Example 1: Ann works in a supermarket for $10.00 per hour. If her pay is increased to $12.00, then what is her percent increase in pay?

Algebra Help - Calculators, Lessons, and Worksheets - Wyzant … Need to practice a new type of problem? We have tons of problems in the Worksheets section. You can compare your answers against the answer key and even see step-by-step solutions for each problem. Browse the list of worksheets to get started… Still need help after using our algebra resources? Connect with algebra tutors and math tutors nearby.

Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ...

Capital Gains Tax Calculation Worksheet - The Balance Capital Gains Tax Calculation Worksheet. Building a worksheet to calculate capital gains shows how the math works. It also illustrates how you can organize your investment data for tax purposes. Here's what you'll need to get started: One worksheet for each stock, bond, or other investment you have. Keep all the purchases on the left side.

PDF Lesson 3 v2 - TreasuryDirect tax. 6. calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi-step problems Personal Finance Concepts income, saving, taxes, gross income, net income ...

Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3 The listed price of a dress is $59.99. If the tax is 8%, what is the total cost?...

How to Solve Percent Problems? (+FREE Worksheet!) - Effortless Math Exercises for Calculating Percent Problems Percent Problems Solve each problem. \(51\) is \(340\%\) ... Reza is an experienced Math instructor and a test-prep expert who has been tutoring students since 2008. ... SSAT Upper-Level Math Worksheets: FREE & Printable;

7th Grade Math. Texas Essential Knowledge and Skills (TEKS) … 7th Grade Math. Topics: Fraction Operations, Exponents, Factors And Fractions, Using Integers, Rational And Irrational Numbers, The Pythagorean Theorem, Nonlinear Functions And Set Theory. Printable worksheets shared to Google Classroom. Texas Essential Knowledge and Skills (TEKS).

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

Trapezoid Bases, Legs, Angles and Area, The Rules and Formulas Properties. Property #1) The angles on the same side of a leg are called adjacent angles and are supplementary() Property #2) Area of a Trapezoid = $$ Area = height \cdot \left( \frac{ \text{sum bases} }{ 2 } \right) $$ () Property #3) Trapezoids have a midsegment which connects the mipoints of the legs()

Markup, discount, and tax - Math Worksheet x 155 = 12 100 Now, cross multiply. x ∙ 100 = 12 ∙ 155 100 x = 1860 x = 18.6 18.6 is 12% of 155. Example 2: Let's try another. 9 is what percent of 215? 9 will be our "IS", 215 is our "OF" and we are looking for our percent. 9 215 = x 100 9 ∙ 100 = x ∙ 215 900 = 215 x x = 4.19 Now let's apply this to shopping and figuring out discounts and taxes.

Quiz & Worksheet - How to Calculate Property Taxes | Study.com Print Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000...

Calculate Sales Tax | Worksheet | Education.com Entire Library Worksheets Fourth Grade Math Calculate Sales Tax. Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

Self-Employed Individuals – Calculating Your Own Retirement … Nov 05, 2021 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

Extraneous solution calculator - softmath free printable math worksheets. grade 4/5 ; method to solve first order differentiation ; free worksheet generator, equations with variables on both sides ; gr 8 math worksheets ; 6th math + box-and-whiskers-plots ; how to calculate exponents in square root ; letter multiplying integers ; slope calculater ; java aptitude questions for free download

0 Response to "45 calculating tax math worksheets"

Post a Comment